Triggering Mobile Money Payment Requests from Form Inputs

Automating Mobile Money Payments from e-Form Inputs using OpenFn: A Game Changer

Collecting data in the field and triggering real-time Mobile Money payments shouldn’t require jumping between spreadsheets, messaging threads, and manual bank instructions. Yet many organizations still spend hours each week manually processing payments that could happen automatically within minutes of data collection. At OpenFn, we believe these processes should be as automated, traceable and scalable as possible. When they are, organizations can do more, faster, and with fewer errors.

This is why organizations use OpenFn to integrate digital forms with mobile payment providers, so that funds reach the right people faster, with less manual work. By connecting mobile money platforms to data collection apps, organizations can automatically send or collect payments when sales are logged, surveys are completed, or deliveries are confirmed—eliminating the need for manual payment processing. Whether you're distributing aid, closing deals, paying field staff, or processing vendor payments, this approach offers speed, traceability, and peace of mind.

And while we’ll walk through a Kobo-to-mPesa example, the magic of OpenFn lies in its flexibility: this integration can be built with any form platform and any Mobile Money provider. That’s the beauty of an automation platform that plays nicely with everything.

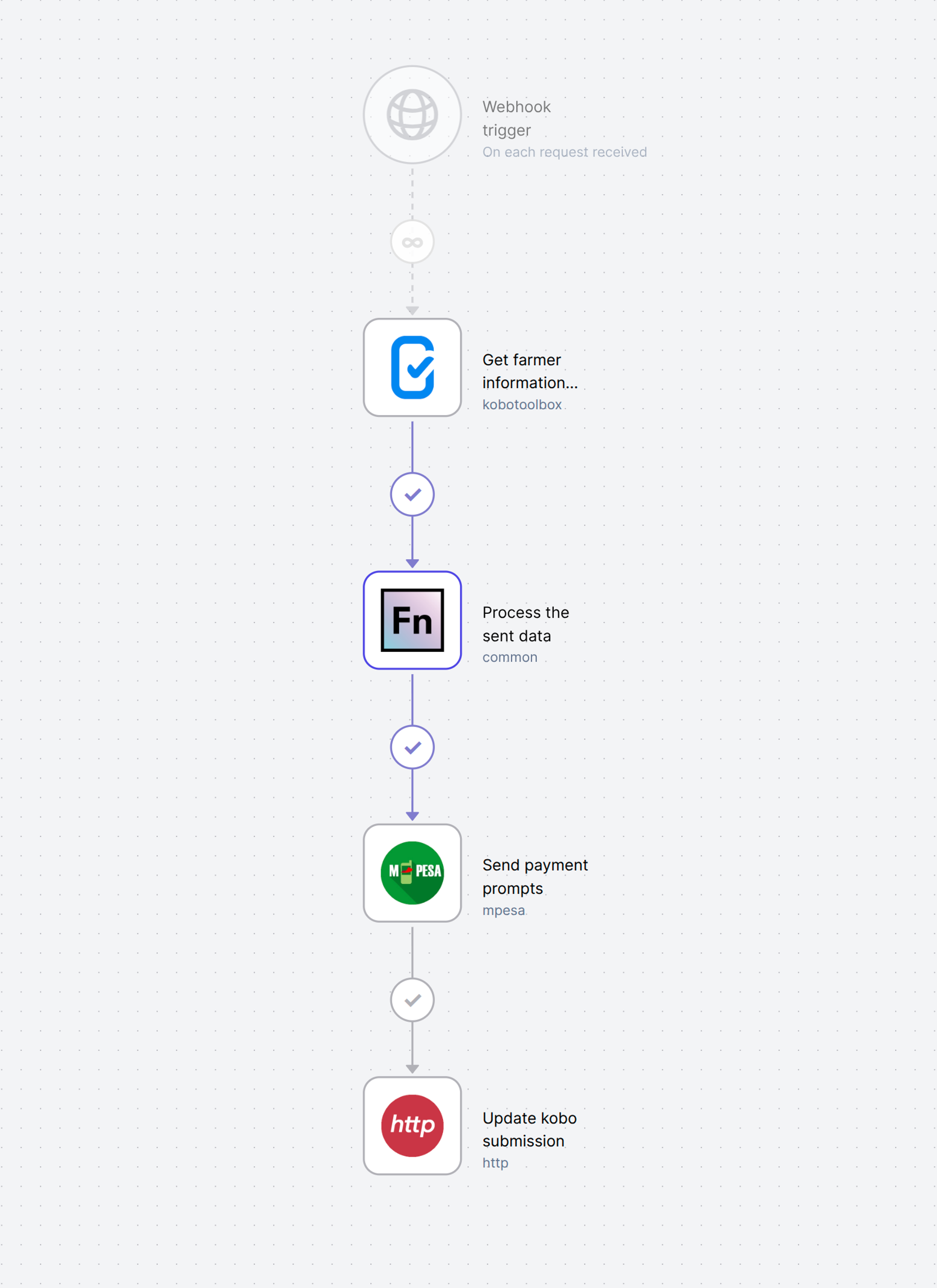

From Form Submission to Mobile Money Payment: How It Works

From a KoboToolbox form it sends a payment request to that user via the Mpesa API.

Let’s say a field agent submits a KoboCollect form capturing key details about a beneficiary - phone number, transfer amount, maybe a programme ID. As soon as that form is submitted, OpenFn springs into action.

- The form data triggers a workflow in OpenFn.

- OpenFn validates the phone number, checks eligibility, and confirms that this person hasn’t already received a transfer this month.

- OpenFn sends a payment request to the end user via your preferred Mobile Money provider (we can replicate this workflow for ANY Momo Provider).

- Responses are logged and synced with other systems - so programme teams and finance leads can track every step.

The result? A fully automated, real-time, audited payment process - no bottlenecks, no manual steps.

In practice, we've seen organizations managing large scale programs automate their entire financial operations via OpenFn - from program registration, to expense tracking in accounting systems and performance updates in project management platforms. What used to require manual data entry and reconciliation across multiple systems can now happen automatically, ensuring accurate financial reporting, real-time program monitoring, and faster decision-making.

Why It Matters Now More Than Ever

(Photo by: Ingeborg Korme on Unsplash)

We’re not the only ones excited about this. Mobile Money is booming.

In fact, 2024 saw mobile money usage reach an all-time high of 1.1 billion accounts globally, with more than half of those based in Africa (TechAfrica News). That’s $1.68 trillion in transactions last year alone (GSMA Report 2025). A massive shift that shows how embedded these platforms have become in daily life, business, and development.

More than ever, governments, NGOs, and social enterprises are turning to Mobile Money for delivering financial support. In Sub-Saharan Africa alone, 28% of adults now have a Mobile Money account, often in place of traditional banking services (World Bank Group).

This creates a huge opportunity: to digitize not just the payment itself, but the systems that power these disbursements - starting from the moment someone enters their details on a mobile device.

Not Just Kobo. Not Just mPesa. OpenFn Is Built for Flexibility.

We often get asked: Does this only work with KoboCollect? Or only with mPesa? Not at all.

OpenFn is designed to work with the tools you already use. You can:

- Connect any data collection platform - ODK, SurveyCTO, CommCare, Google Forms, or your own custom app

- Trigger workflows from any source - form submissions, case management systems, spreadsheets, SMS, or databases via Webhook Triggers.

- Connect to any payment provider - mPesa, MTN MoMo, Orange Money, or another system of record or financial gateway.

If you don’t yet have APIs set up for your system(s) of choice, get in touch with our team for support.

Built for Developers, Designed to Include Everyone

For technical teams, OpenFn offers robust tools like JavaScript-based job templates, secure credential management, and real-time monitoring. It’s a powerful platform for building complex, custom automation workflows across diverse systems.

That said, we know integration doesn’t start with code. It starts with an idea, a requirement, or a business need. Our new AI Assistant and workflow template library helps programme managers and stakeholders explore automation ideas in plain language - so they can scope needs, test logic, and collaborate more effectively with developers when it's time to build.

Bringing Clarity, Speed, and Control to Payment Workflows

(Photo by: 1Click on Unsplash)

Manual payment processes are not only time-consuming, they can introduce delays, errors, and compliance risks. By automating payments from form inputs, organizations improve data accuracy, reduce delays, and create a transparent, auditable flow from beneficiary registration to funds disbursement.

Whether you’re scaling up a social cash transfer programme or simply trying to reduce back-office burden, automating payment triggers with OpenFn gives your team more time to focus on impact.

This is Just the Beginning

This blog is the first in a three-part series where we’ll explore:

- Triggering Mobile Money Payments from Form Inputs (you’re here!)

- Connecting apps across your ecosystem to streamline payments and reduce admin overhead

- Leveraging the OpenG2P framework to digitize entire government-to-person (G2P) delivery systems

While payments are just one step in the process, they’re often the most critical and the most time-sensitive. Automation unlocks scale, trust, and real-time responsiveness.

The real power emerges when you connect multiple systems in your workflow. Imagine a beneficiary submitting a form that not only triggers a mobile money payment, but also updates your accounting system, logs the transaction in your project management platform, and generates real-time reporting for stakeholders - all automatically.

Let’s Build Something that Works for You

Curious how this could work in your programme? Check out the website at OpenFn.org or book a free consultation with our team to get you started. We’ll help you design a workflow tailored to your tools, your rules, and your impact goals.

If you would like to try it on your own, get started on the OpenFn platform. It’s free for 1 workflow and as little as $49 per month for two workflows - saving hours of your colleagues’ time. Check out our pricing page for the various options.

Remember: if you can describe it, we can probably automate it.

Written by

Justine Stewart